ERP finance module

Month-end closing is a crucial task for finance teams in every organization. It involves reconciling accounts, validating transactions, preparing reports, and ensuring all financial data is accurate. Traditional processes are often manual, slow, and prone to errors, which can cause reporting delays and compliance issues.

Table of Contents

ToggleHow ERP Finance Module Streamlines Month-End Closings

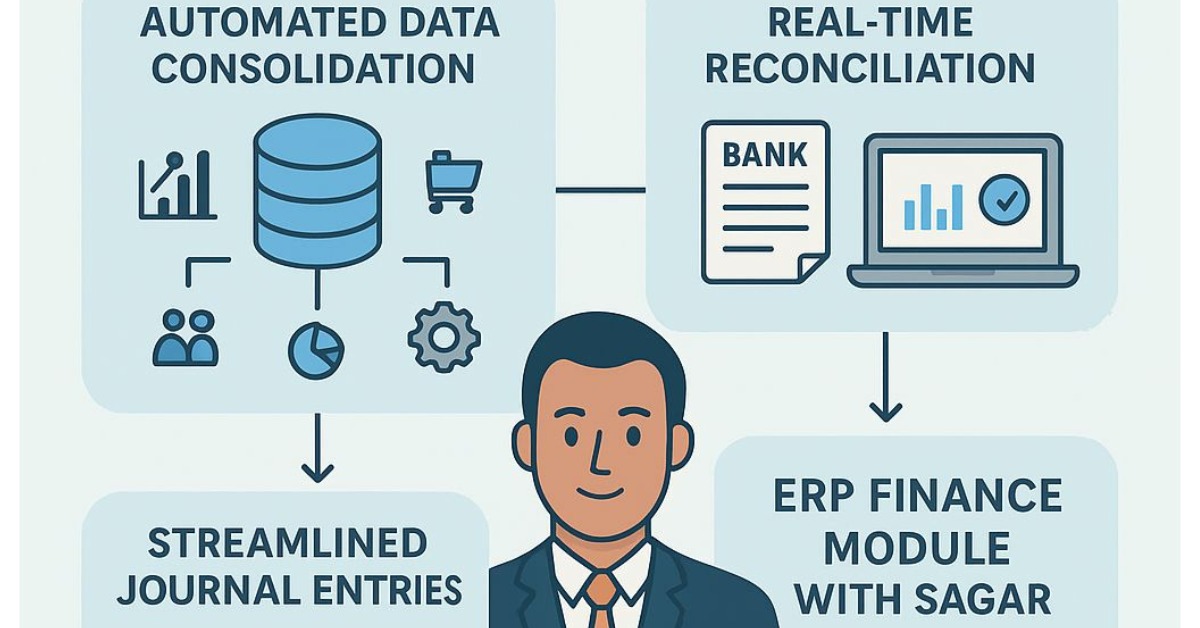

An ERP finance module centralizes financial operations, integrates departmental data, and provides real-time visibility into accounts. By automating reconciliations, journal entries, and reporting, businesses reduce errors and complete month-end closings faster. Here’s how the ERP finance module with Sagar achieves this:

- Automated Data Consolidation: The ERP finance module with Sagar gathers financial data from departments such as sales, procurement, and operations. This eliminates manual entry, ensures all data is consolidated, and provides a single source of truth for month-end reporting.

- Real-Time Reconciliation: Bank statements, invoices, and ledger entries are automatically matched. The system flags discrepancies immediately, helping finance teams correct issues before closing. This ensures accuracy and speeds up the month-end process.

- Streamlined Journal Entries : Recurring journal entries, adjustments, and accruals are generated automatically. Manual calculations are no longer necessary, reducing errors and maintaining consistent financial records.

- Automated Reporting : Balance sheets, profit and loss statements, and cash flow reports are produced instantly. The ERP finance module ensures reports comply with accounting standards and facilitates faster decision-making.

- Audit Trail and Compliance: Every transaction processed through the ERP finance module is recorded with a detailed audit trail. This ensures transparency, eases audits, and supports regulatory compliance.

Before these points, it’s important to note that the ERP finance module not only speeds up month-end closing but also reduces stress for finance teams, making their workflow smoother and more predictable.

Key Features That Boost Accuracy

The ERP finance module with Sagar enhances accounting accuracy and operational efficiency. Multiple users can collaborate simultaneously, share information, and approve transactions without delays. Automation reduces repetitive manual tasks and errors. Standardized processes ensure consistency across departments, while real-time visibility allows management to make informed decisions confidently.

Benefits Beyond Month-End Closing

Using the ERP finance module with Sagar extends benefits beyond closing cycles:

- Time Savings: Automated processes shorten closing cycles and free finance teams to focus on strategic initiatives.

- Improved Decision-Making : Real-time, accurate financial data empowers management to make informed decisions faster.

- Cost Efficiency : Reduced manual effort and minimized errors lower operational costs.

- Scalability: The ERP finance module can handle growing transaction volumes as businesses expand without adding manual workload.

By integrating month-end closing automation and financial process automation, organizations can streamline operations, save costs, and maintain high accounting accuracy.

Conclusion

The ERP finance module with Sagar transforms month-end closing by automating data consolidation, reconciliation, journal entries, and reporting. It improves accuracy, reduces errors, saves time, and ensures compliance. Businesses adopting this module benefit from faster, more reliable month-end closings and can redirect focus from manual accounting tasks to strategic growth initiatives. For companies looking to streamline financial processes and boost operational efficiency, implementing an ERP finance module is essential.